In today's rapidly evolving financial landscape, traditional competitive strategies are no longer sufficient for finance firms aiming to thrive and stay relevant. Instead, businesses in the finance sector are increasingly turning to a business ecosystem strategy to create value, foster innovation, and secure their position in the industry.

In this article I discuss the reasons why a finance firm should adopt a business ecosystem strategy. I explore specific ways to implement it within the financial ecosystem, highlight key differences compared to conventional competitive strategies, discuss the benefits it offers, and provide insights on identifying opportunities and implementing this strategy effectively.

I then discuss an example of a successful business ecosystem strategy, critically review such a strategy, and compare it with a more conventional strategy.

Finally I establish the bottom line in terms of each of these strategies.

The Finance Ecosystem

Let’s begin by understanding what the Financial Ecosystem is. A simple way of understanding it is to identify the key players and the value flows between them.

Key Players

Here is an illustrative list of some players in the financial business ecosystem:

- Banks: Traditional banks play a central role in the financial ecosystem by providing a wide range of financial services, including savings accounts, loans, and investments.

- Credit Unions: Similar to banks, credit unions offer financial services but are member-owned and often serve specific communities or groups.

- Payment Processors: Companies like Visa, Mastercard, and American Express facilitate electronic transactions by providing payment card networks.

- Online Payment Services: PayPal, Square, and Stripe offer online payment solutions, enabling individuals and businesses to send and receive money electronically.

- Fintech Start-ups: Innovative financial technology start-ups, including Robinhood, Square, and Coinbase, introduce disruptive solutions like trading apps, payment platforms, and cryptocurrency exchanges.

- Investment Banks: Investment banks like Goldman Sachs and Morgan Stanley provide financial advisory services, asset management, and capital raising for corporations and institutional clients.

- Stock Exchanges: Major stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ facilitate the trading of publicly traded company shares.

- Regulators: Government regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Federal Reserve, oversee and regulate the financial industry.

- Insurance Companies: Insurance providers like Allstate, AIG, and Progressive offer various insurance products, including auto, home, and life insurance.

- Asset Management Firms: Companies like BlackRock and Vanguard manage investment portfolios on behalf of individuals and institutions.

- Peer-to-Peer Lenders: Platforms like LendingClub and Prosper connect borrowers with individual investors willing to lend money.

- Central Banks: Entities like the Federal Reserve in the U.S. control monetary policy, influence interest rates, and manage the money supply.

- Hedge Funds: Hedge funds, such as Bridgewater Associates and Renaissance Technologies, manage high-risk investment portfolios for accredited investors.

- Credit Rating Agencies: Firms like Moody's and Standard & Poor's assess the creditworthiness of borrowers and issuers of financial instruments.

- Online Brokers: Companies like E*TRADE and Charles Schwab offer online brokerage services, allowing individuals to trade stocks, bonds, and other securities.

- Mobile Banking Apps: Mobile banking apps from traditional banks and fintech firms, such as Chime and Ally Bank, provide convenient access to banking services on smartphones.

- Real Estate Investment Trusts (REITs): REITs like Simon Property Group and Prologis invest in real estate assets and offer shares to investors.

- Venture Capital Firms: Venture capital firms, including Sequoia Capital and Andreessen Horowitz, invest in early-stage start-ups in exchange for equity.

- Mortgage Lenders: Mortgage lenders, such as Quicken Loans and Wells Fargo, provide loans for purchasing or refinancing homes.

- Financial Advisors: Professionals like certified financial planners (CFPs) and registered investment advisors (RIAs) offer financial planning and investment advice.

- Commercial Banks: Commercial banks like JPMorgan Chase and Bank of America serve businesses by offering corporate banking, lending, and treasury services.

- Cryptocurrency Exchanges: Cryptocurrency exchanges like Binance and Kraken enable the buying, selling, and trading of cryptocurrencies like Bitcoin and Ethereum.

- Private Equity Firms: Private equity firms, such as The Carlyle Group and KKR, invest in private companies and often take active roles in their management.

- Insurance Brokerage Firms: Companies like Marsh & McLennan and Aon provide insurance brokerage and risk management services to businesses.

- Online Payment Gateways: Online payment gateway providers, including Authorize.Net and Worldpay, enable e-commerce businesses to process online payments securely.

Value Flows

In the financial business ecosystem, various players engage in value flows, which represent the exchange of value, services, or assets between them. To illustrate, here are some example value flows between some of the players:

Banks:

- Value Flow to Customers: Banks provide financial services like savings accounts, loans, and investment opportunities, allowing customers to secure their finances, access credit, and earn interest.

- Value Flow to Regulators: Banks report financial data, comply with regulations, and contribute to the stability of the financial system.

Payment Processors:

- Value Flow to Merchants: Payment processors enable merchants to accept electronic payments, facilitating sales and revenue generation.

- Value Flow to Banks: Payment processors transfer funds between banks, ensuring smooth and secure transactions.

Online Payment Services (e.g., PayPal):

- Value Flow to Consumers: Online payment services offer convenient, secure, and efficient ways for consumers to make payments, manage funds, and protect financial information.

- Value Flow to Merchants: Merchants receive payments from consumers via online payment services, reducing payment processing friction.

- Value Flow to Regulators: Online payment services adhere to financial regulations and provide transaction data to regulators.

Fintech Start-ups:

- Value Flow to Consumers: Fintech startups offer innovative financial products and services, providing consumers with new opportunities for managing money, investing, and accessing credit.

- Value Flow to Investors: Venture capital firms and individual investors fund fintech startups in exchange for equity or returns on investment.

Investment Banks:

- Value Flow to Corporations: Investment banks assist corporations in raising capital through activities like initial public offerings (IPOs) and debt issuance.

- Value Flow to Investors: Investment banks provide investment research and advisory services to help investors make informed decisions.

Stock Exchanges:

- Value Flow to Investors: Stock exchanges facilitate the buying and selling of stocks, allowing investors to trade securities and access investment opportunities.

- Value Flow to Listed Companies: Companies benefit from raising capital by listing their shares on stock exchanges.

Regulators:

- Value Flow to the Public: Regulators enforce rules and regulations to protect consumers and maintain the integrity of the financial system, enhancing public trust.

- Value Flow to Financial Institutions: Regulators provide oversight and guidance to financial institutions, ensuring compliance with regulatory requirements.

Insurance Companies:

- Value Flow to Policyholders: Insurance companies offer coverage and protection to policyholders in exchange for premium payments.

- Value Flow to Reinsurers: Insurance companies may transfer risk to reinsurers in exchange for a portion of the premiums collected.

Asset Management Firms:

- Value Flow to Investors: Asset management firms manage investment portfolios, aiming to generate returns and provide investment options for investors.

- Value Flow to Asset Owners: Institutional investors and individuals entrust their assets to asset management firms for professional management.

Peer-to-Peer Lenders:

- Value Flow to Borrowers: Peer-to-peer lending platforms connect borrowers with individual lenders, offering loans at competitive rates.

- Value Flow to Lenders: Lenders receive interest income on loans provided to borrowers.

Central Banks:

- Value Flow to Commercial Banks: Central banks influence interest rates and provide liquidity support to commercial banks, ensuring financial stability.

- Value Flow to the Government: Central banks may contribute profits to the government, increasing government revenue.

Hedge Funds:

- Value Flow to Investors: Hedge funds aim to generate returns for accredited investors, providing opportunities for diversification and potentially high returns.

- Value Flow to Fund Managers: Hedge fund managers earn management fees and performance fees based on the fund's performance.

Credit Rating Agencies:

- Value Flow to Investors: Credit rating agencies assess the creditworthiness of issuers, helping investors make informed decisions on bond and debt investments.

- Value Flow to Issuers: Companies and governments seek credit ratings to access capital markets and demonstrate credit quality.

Online Brokers:

- Value Flow to Traders: Online brokers enable individuals to trade securities, offering access to stock exchanges and investment products.

- Value Flow to Exchanges: Online brokers execute trades on stock exchanges, contributing to trading volumes.

Mobile Banking Apps:

- Value Flow to Consumers: Mobile banking apps provide convenience and accessibility for managing bank accounts, making payments, and conducting financial transactions.

- Value Flow to Banks: Banks use mobile banking apps to engage and serve customers digitally.

These value flows represent the intricate interplay of services and transactions within the financial ecosystem, highlighting the roles and interactions of key players. The flow of value helps drive economic activity, support financial markets, and meet the diverse needs of consumers, businesses, and investors.

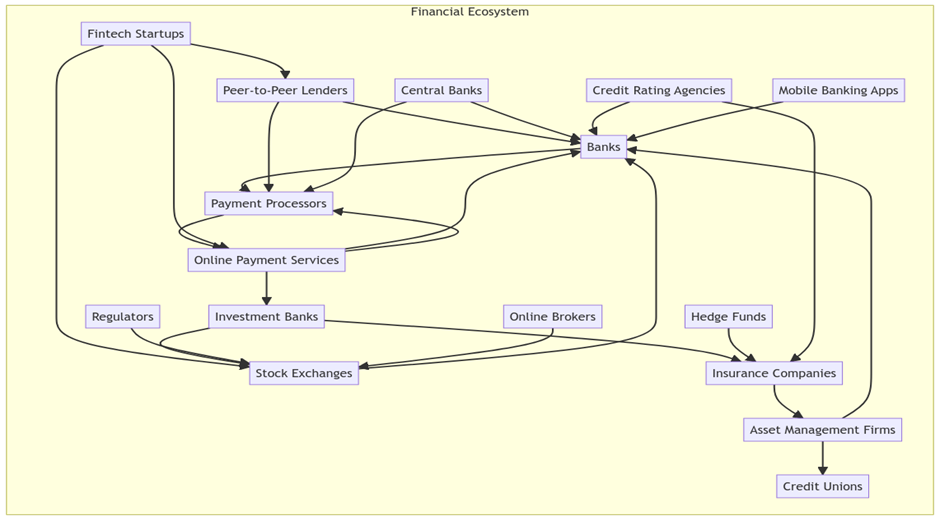

Ecosystem Map

Based upon the players and the value flows, I have created a map of the ecosystem as shown at the start of the article. Such a map helps to visually understand the ecosystem and can be further packed with relevant information regarding players, value flows and groupings that help in developing strategy.

Finance Ecosystem: Why Adopt a Business Ecosystem Strategy?

In the finance sector, adopting a business ecosystem strategy makes strategic sense for several compelling reasons including:

- Complex Interconnections: The financial ecosystem is highly interconnected, with numerous players including banks, fintech start-ups, regulators, and investors. A business ecosystem strategy acknowledges and leverages these connections, enabling a finance firm to tap into a broader network of partners and stakeholders.

- Rapid Technological Advancements: The finance industry is undergoing a digital transformation, driven by technological innovations. A business ecosystem strategy allows firms to collaborate with tech-savvy partners, fostering innovation and adaptation to technological changes.

- Changing Customer Expectations: Customers in the finance sector demand personalized, convenient, and seamless services. A business ecosystem strategy enables firms to offer a wider range of services through partnerships, meeting these evolving customer expectations.

Specific Ways to Adopt a Business Ecosystem Strategy

For a finance firm to embrace a business ecosystem strategy within the financial ecosystem, it should consider the following approaches:

- Partnerships and Alliances: Form strategic partnerships with complementary businesses. For example, a traditional bank could partner with a fintech start-up to offer digital payment solutions.

- Open APIs and Platforms: Develop open APIs and platforms that allow third-party developers and businesses to build on top of your infrastructure. This opens the door to innovation and new revenue streams.

- Data Sharing: Collaborate with other ecosystem players to share data securely. This can lead to better risk assessment, fraud detection, and customer insights.

- Cross-Selling: Cross-sell products and services with ecosystem partners. For instance, a wealth management firm could offer insurance products through an alliance with an insurance provider.

- Regulatory Compliance: Ensure that your ecosystem strategy aligns with regulatory requirements. Regulatory bodies play a crucial role in the finance ecosystem, and compliance is non-negotiable.

Key Differences Between Business Ecosystem and Competitive Strategies

To understand the distinction between a business ecosystem strategy and a conventional competitive strategy in the finance sector, let's consider some key differences:

- Collaboration vs. Competition: While competitive strategies focus on outperforming rivals, ecosystem strategies prioritize collaboration. Finance firms in an ecosystem work together to create value for all participants.

- Network Effects: Ecosystem strategies harness network effects, where the value of the ecosystem increases as more participants join. In contrast, competitive strategies often operate in zero-sum dynamics.

- Innovation: Ecosystems foster innovation through the exchange of ideas, technologies, and resources among participants. Competitive strategies may limit innovation to internal efforts.

- Customer-Centric Approach: Ecosystem strategies tend to be more customer-centric, aiming to meet diverse customer needs through a wide range of partners. Competitive strategies may have a narrower customer focus.

- Risk Sharing: Ecosystems allow for risk-sharing among participants. If one member of the ecosystem faces challenges, others can provide support. Competitive strategies typically involve bearing risks individually.

Finance Ecosystem: Benefits

A well-executed business ecosystem strategy in the finance sector can yield numerous benefits:

- Enhanced Innovation: Collaboration within the ecosystem facilitates the exchange of innovative ideas and technologies, keeping firms at the forefront of industry advancements.

- Expanded Customer Base: Partnering with other ecosystem players broadens the customer base and enables cross-selling opportunities, increasing revenue potential.

- Cost Efficiency: Shared resources and infrastructure can lead to cost savings, particularly in areas like technology development and cybersecurity.

- Agility and Adaptability: Ecosystems are more adaptable to changing market conditions, allowing firms to pivot quickly and stay competitive.

- Sustainability: The network effects and collaborative nature of ecosystems create a sustainable advantage over time, reducing the threat of disruption.

Finance Ecosystem: Opportunities

Adopting a business ecosystems strategy can result in several opportunities for the firm. Let us discuss at a very high level how to identify opportunities, the types of opportunities, and the types of intervention that the firm can make in response to those opportunities to obtain a sustainable competitive advantage.

Identifying Opportunities

Identifying opportunities in the financial ecosystem requires a keen understanding of market dynamics and a proactive approach. Here are some strategies to consider:

- Market Research: Stay informed about industry trends, customer preferences, and emerging technologies through market research and analysis.

- Networking: Build relationships with other ecosystem players, attend industry events, and engage in discussions to uncover potential collaboration opportunities.

- Customer Feedback: Listen to customer feedback and identify unmet needs or pain points that can be addressed through partnerships or new services.

- Competitor Analysis: Study the strategies of competitors and ecosystem partners to identify gaps that your firm can fill.

Types of Opportunities

A financial firm operating within a finance ecosystem can tap into various opportunities to grow, innovate, and remain competitive. Here are some of the key opportunities that can exist:

- Fintech Collaboration: Partnering with fintech start-ups and technology companies can enable traditional financial firms to harness innovation and offer cutting-edge solutions. Fintech collaborations can lead to the development of digital payment platforms, robo-advisors, blockchain applications, and more.

- Digital Banking: The shift towards digital banking presents opportunities for financial firms to offer online banking services, mobile apps, and digital wallets. These platforms can enhance customer experiences and attract tech-savvy consumers.

- Wealth Management: With the rising importance of wealth management and retirement planning, financial firms can expand their services in this area. Offering personalized wealth management solutions, investment advisory services, and retirement planning can be lucrative.

- RegTech and Compliance: Regulatory technology (RegTech) solutions help financial institutions streamline compliance processes and reduce regulatory risks. Developing or partnering with RegTech firms can be beneficial in ensuring compliance and minimizing regulatory penalties.

- Data Analytics: Leveraging big data analytics and artificial intelligence (AI) can provide financial firms with valuable insights into customer behaviour, risk assessment, and fraud detection. Data-driven decision-making can lead to more targeted marketing and risk management strategies.

- Cybersecurity Services: As cyber threats continue to evolve, there is a growing demand for cybersecurity services in the financial sector. Offering robust cybersecurity solutions to protect customer data and assets is a promising opportunity.

- Ecosystem Partnerships: Collaborating with other ecosystem players, such as insurance companies, investment banks, and payment processors, can lead to cross-selling opportunities and the creation of comprehensive financial services.

- Financial Inclusion: Addressing the unbanked and underbanked populations presents opportunities for financial firms to expand their customer base. Microfinance, mobile banking, and inclusive financial products can bridge the gap.

- Sustainable Finance: The increasing focus on environmental, social, and governance (ESG) criteria provides opportunities for firms to develop ESG-related investment products and sustainable finance solutions.

- Cross-Border Expansion: Expanding operations internationally or serving clients with cross-border financial needs can be lucrative. This includes foreign exchange services, international trade finance, and global investment opportunities.

- Alternative Investments: Offering alternative investment options, such as private equity, hedge funds, and venture capital, can attract high-net-worth individuals and institutional investors seeking diversification.

- Artificial Intelligence and Chatbots: Implementing AI-powered chatbots and virtual assistants can enhance customer service and streamline routine inquiries, improving operational efficiency.

- Financial Education: Providing financial education and literacy programs can help build trust with customers and empower them to make informed financial decisions.

- Real-time Payments: Developing real-time payment solutions and participating in instant payment networks can meet the demand for faster and more convenient transaction processing.

- Blockchain and Cryptocurrency: Exploring blockchain technology and digital assets can open doors to new revenue streams and payment methods, although they come with regulatory and security considerations.

- Insurance and Risk Management: Expanding into insurance services, such as life insurance, health insurance, or property insurance, can complement a financial firm's offerings and provide a diversified revenue stream.

- Government Partnerships: Partnering with government agencies on initiatives related to financial inclusion, economic development, or infrastructure financing can lead to significant opportunities.

- Savings and Investment Apps: Developing user-friendly mobile apps for savings, investing, and personal finance management can attract a younger demographic and digitally native customers.

To identify and capitalize on these opportunities effectively, financial firms should remain agile, stay abreast of industry trends, conduct thorough market research, and be open to collaboration with ecosystem partners. Additionally, they should prioritize customer-centricity and compliance with regulatory requirements to build trust and credibility within the financial ecosystem.

Types of Interventions

A financial firm operating within a finance ecosystem can employ various interventions to gain a competitive advantage. These interventions are strategic actions and approaches that can help the firm thrive and differentiate itself in a highly competitive industry. Here are some key interventions:

Disruption:

- Innovation and Technology Adoption: Embrace disruptive technologies like blockchain, AI, and fintech solutions to revolutionize traditional financial services. For example, implementing blockchain for secure and transparent transactions can disrupt legacy processes.

- Digital Transformation: Shift from brick-and-mortar operations to a digital-first approach, providing customers with seamless online experiences, 24/7 access, and faster transactions.

Cost Reduction: Disrupt traditional cost structures through automation, reducing operational expenses, and passing the cost savings on to customers.

Leveraging:

- Data and Analytics: Leverage customer data and advanced analytics to gain insights into customer behaviour, enabling personalized offerings, risk assessment, and fraud detection.

- Ecosystem Partnerships: Collaborate with ecosystem partners to leverage their strengths and resources. For instance, partnering with a technology firm to enhance digital capabilities.

- Regulatory Expertise: Develop deep expertise in navigating complex regulatory environments to gain a competitive edge in compliance and risk management.

Amplifying:

- Brand Amplification: Invest in brand building and marketing efforts to amplify your firm's reputation and visibility within the financial ecosystem.

- Customer Engagement: Enhance customer engagement through personalized services, responsive customer support, and loyalty programs to amplify customer satisfaction and retention.

- Thought Leadership: Establish thought leadership by publishing insightful content, participating in industry events, and contributing to discussions on key financial topics.

Differentiation:

- Product and Service Innovation: Introduce innovative financial products and services that cater to specific customer needs or market niches, differentiating your offerings from competitors.

- Customer-Centric Approach: Prioritize customer experience by offering personalized, efficient, and user-friendly services that set your firm apart from others.

- Sustainable Finance: Differentiate by aligning with environmental, social, and governance (ESG) principles, offering sustainable finance solutions that appeal to socially conscious investors.

Risk Management:

- Advanced Risk Assessment: Implement advanced risk assessment models and methodologies to minimize credit and market risks, ensuring a more stable and secure financial position.

- Diversified Portfolio: Diversify the investment portfolio to spread risks across various asset classes and geographies, reducing vulnerability to market fluctuations.

Operational Efficiency:

- Lean Operations: Streamline internal processes, reduce bureaucracy, and promote a culture of efficiency and continuous improvement to optimize resource utilization.

- Robotic Process Automation (RPA): Integrate RPA to automate routine tasks and improve operational efficiency while reducing human error.

Regulatory Compliance:

- Proactive Compliance: Proactively comply with changing regulations by investing in robust compliance management systems and keeping abreast of legal developments.

- Regulatory Partnerships: Collaborate with regulators and industry associations to help shape regulatory frameworks and standards, ensuring that they align with your business goals.

Global Expansion:

- International Presence: Expand globally to tap into new markets and diversify your customer base. This may involve entering emerging markets or establishing strategic partnerships with international firms.

Customer Education:

- Financial Literacy Initiatives: Offer educational resources and workshops to enhance customer financial literacy, fostering trust and long-term relationships.

Savings and Efficiency Measures:

- Cost Savings: Implement cost-saving measures through process optimization, bulk purchasing, and effective resource allocation.

- Resource Reallocation: Shift resources from low-impact areas to high-impact growth initiatives.

Cybersecurity and Risk Mitigation:

- Advanced Security: Invest in cutting-edge cybersecurity measures to protect customer data and assets, reassuring customers and partners of your commitment to security.

- Disaster Recovery and Business Continuity: Develop robust disaster recovery and business continuity plans to mitigate the impact of unexpected disruptions.

Customer-Centric Innovation:

- Co-Creation: Collaborate with customers to co-create financial products and services that directly address their needs and preferences.

- Feedback Loops: Create mechanisms for collecting and acting on customer feedback to drive continuous improvement.

A combination of these interventions, tailored to the firm's specific strengths and market dynamics, can help a financial firm achieve a sustainable competitive advantage. The key is to remain adaptable, responsive to market changes, and customer-centric while pursuing these strategies.

Developing and Implementing a Business Ecosystem Strategy

Developing and implementing a business ecosystem strategy in the finance sector involves several key steps:

- Define Clear Objectives: Clearly articulate your goals and objectives for participating in the ecosystem. Are you seeking growth, innovation, or cost savings?

- Identify Key Partners: Select partners that align with your objectives and complement your strengths and weaknesses.

- Develop a Governance Model: Establish a governance structure to manage relationships, data sharing, and decision-making within the ecosystem.

- Technology Enablement: Invest in the necessary technology infrastructure, such as APIs and data-sharing platforms, to enable seamless collaboration.

- Monitor and Adapt: Continuously monitor the performance of your ecosystem strategy, gather feedback, and be prepared to adapt to changing circumstances.

So we see why, in the dynamic and interconnected world of finance, a business ecosystem strategy is increasingly becoming a preferred approach for firms looking to create value, foster innovation, and remain competitive. By embracing collaboration, leveraging network effects, and prioritizing customer-centricity, finance firms can navigate the financial ecosystem successfully, seize new opportunities, and secure a sustainable future in an ever-evolving industry.

Finance Ecosystem Example: PayPal’s Business Ecosystem Strategy

A successful example of a business ecosystem strategy in the finance ecosystem is the partnership and ecosystem developed by PayPal Holdings, Inc. PayPal has strategically leveraged its ecosystem to create value, expand its reach, and remain competitive in the rapidly evolving digital payments and financial services industry.

- Open APIs and Developer Platform: PayPal has developed a robust set of open APIs and a developer platform that allows third-party developers, businesses, and start-ups to build upon its payment infrastructure. This initiative, known as the PayPal Commerce Platform, enables businesses to embed PayPal's payment capabilities into their own applications, websites, and services.

- Acquisitions and Partnerships: PayPal has strategically acquired fintech companies and formed partnerships with various players in the financial ecosystem. For instance, its acquisition of Braintree brought in popular payment processing solutions like Venmo. Partnerships with credit card companies, banks, and retailers have expanded its ecosystem even further.

- Cross-Border Expansion: PayPal has expanded globally, making its services available in over 200 markets. This global reach has enabled it to tap into diverse customer bases and cater to the growing demand for cross-border payments.

- Financial Inclusion: PayPal has also focused on financial inclusion by offering services to the unbanked and underbanked populations. Through partnerships with microfinance institutions and mobile money providers, PayPal has facilitated access to financial services for previously underserved communities.

- Mobile Payments: The acquisition of mobile payment pioneer Venmo and the integration of One Touch checkout have positioned PayPal as a leader in mobile payments, catering to the increasing preference for mobile and contactless transactions.

Benefits and Successes:

PayPal's business ecosystem strategy has yielded several notable benefits and successes:

- Network Effects: By opening its platform to developers and forming partnerships with a wide range of businesses, PayPal has harnessed network effects. As more businesses and users join the ecosystem, the value of PayPal's services increases for all participants.

- Innovation: The ecosystem strategy has fostered innovation, with developers creating a variety of applications and solutions that leverage PayPal's payment capabilities. This has allowed PayPal to stay at the forefront of digital payment technology.

- Diversification: PayPal's ecosystem includes various financial services beyond basic payment processing, such as lending, financial management tools, and cryptocurrency services, diversifying its revenue streams.

- Customer-Centric Approach: The convenience and user-friendly nature of PayPal's services, combined with its ecosystem partnerships, have enhanced the customer experience and boosted customer loyalty.

- Global Reach: PayPal's cross-border capabilities have attracted international customers and businesses, contributing to its global success.

- Financial Inclusion: By providing access to digital financial services to previously excluded populations, PayPal has contributed to financial inclusion and social impact.

- Revenue Growth: PayPal's ecosystem strategy has driven significant revenue growth and solidified its position as a leading player in the digital payments and financial services industry.

Overall, PayPal's business ecosystem strategy is a compelling example of how a financial firm can thrive in the finance ecosystem by embracing collaboration, innovation, and customer-centricity, ultimately achieving a sustainable competitive advantage in a rapidly evolving industry. Even today PayPal is not doing too badly at all. It’s earnings are expected to grow by 17.06% in the coming year, from $3.81 to $4.46 per share. (https://www.marketbeat.com/stocks/NASDAQ/PYPL/earnings/)

Disruptions

PayPal disrupted the existing traditional finance ecosystem in several significant ways, fundamentally changing how financial transactions and online payments are conducted in some key ways:

- Online Payments for E-commerce: Before PayPal, online payments were often cumbersome and required users to share sensitive financial information directly with merchants. PayPal introduced a secure and convenient way for consumers to make online payments without revealing their credit card details to multiple websites. This not only improved user trust but also accelerated the growth of e-commerce by making online transactions easier and more secure.

- Digital Wallet Innovation: PayPal pioneered the concept of digital wallets. Users could link their bank accounts or credit cards to a PayPal account, allowing for quick and easy online transactions. This innovation laid the foundation for the broader adoption of digital wallets in the financial industry.

- Cross-Border Payments: PayPal simplified cross-border transactions by allowing users to send and receive money internationally with ease. Traditional international wire transfers were often slow, expensive, and cumbersome. PayPal's platform made cross-border payments faster and more cost-effective.

- Microtransactions and P2P Payments: PayPal made microtransactions and person-to-person (P2P) payments practical. Users could send small amounts of money to friends and family, split bills, or make small online purchases easily. This innovation opened up new use cases for digital payments.

- Developer-Friendly APIs: PayPal was one of the first financial companies to offer open APIs (Application Programming Interfaces) that allowed developers to integrate payment functionality into third-party applications and websites. This move democratized access to online payment processing, enabling the proliferation of online marketplaces, crowdfunding platforms, and other innovative services.

- Security and Buyer Protection: PayPal introduced robust security measures and buyer protection policies, reducing fraud and enhancing trust among online shoppers. This helped alleviate concerns about the safety of online transactions.

- Ecosystem Expansion: PayPal expanded its services beyond payment processing. It ventured into areas like lending, digital wallets (e.g., Venmo), and cryptocurrency services, diversifying its offerings and becoming a comprehensive financial services provider.

- Acquisitions and Partnerships: PayPal strategically acquired and partnered with fintech companies and traditional financial institutions to broaden its reach and offer a wider range of financial services. Notable acquisitions include Braintree and Xoom, which expanded its capabilities in payment processing and international money transfers.

- Mobile Payments: PayPal was an early adopter of mobile payment technology, allowing users to make purchases using their mobile devices. This innovation catered to the growing trend of mobile commerce and contactless payments.

- Marketplace Integration: PayPal became the preferred payment method for many online marketplaces, including eBay, which it once owned. This integration simplified transactions for millions of online sellers and buyers.

- Global Reach: PayPal's services extended internationally, serving customers in over 200 countries and allowing businesses to engage in cross-border commerce more seamlessly.

- Financial Inclusion: Through partnerships with microfinance institutions and mobile money providers, PayPal helped extend financial services to underserved and unbanked populations, contributing to financial inclusion.

PayPal disrupted the existing finance ecosystem by reimagining how online payments and financial transactions are conducted. It introduced convenience, security, and innovation, transforming the way consumers and businesses interact with digital finance. PayPal's disruptive influence continues to shape the financial industry and drive further innovation in the digital payments space.

Impacts

PayPal's disruption of the existing finance ecosystem had a significant impact on various players within the industry, including traditional financial institutions, merchants, consumers, and emerging fintech companies. Here's some of the ways in which different players felt that impact:

Traditional Banks and Credit Card Companies:

PayPal posed a competitive threat to traditional banks and credit card companies by offering an alternative payment method that was more convenient for online shoppers in terms of:

- Reduced transaction fees: PayPal's lower transaction fees for merchants compared to credit card processing fees made it an attractive option for online businesses.

- Loss of market share: PayPal's digital wallet and online payment system led to a shift in consumer behaviour, with some users opting to use their PayPal accounts instead of traditional banking services for online purchases.

Merchants and E-commerce Platforms:

PayPal's secure and user-friendly payment system provided merchants and e-commerce platforms with an effective way to accept online payments in terms of:

- Increased sales: Offering PayPal as a payment option increased conversion rates for many online businesses, as consumers felt more confident in making purchases.

- Enhanced fraud protection: PayPal's buyer protection policies helped merchants reduce fraudulent chargebacks and disputes.

Consumers:

PayPal offered consumers a safer and more convenient way to make online purchases, reducing the need to share credit card information with multiple online merchants in terms of:

- Improved security: PayPal's robust security measures and buyer protection policies instilled trust among consumers, reducing concerns about online fraud.

- Convenience: Shoppers appreciated the one-click payment option and the ability to pay with their PayPal balance or linked bank accounts, streamlining the checkout process.

Fintech Start-ups and Developers:

PayPal's open APIs and developer platform enabled fintech start-ups and developers to integrate payment processing into their applications and services in terms of:

- Innovation: The availability of PayPal's APIs fuelled the growth of new fintech services, such as peer-to-peer payments, crowdfunding platforms, and mobile wallet applications.

- Market entry: PayPal's ecosystem allowed start-ups to enter the online payments space without the need for extensive financial infrastructure.

Credit Unions and Microfinance Institutions

PayPal's initiatives for financial inclusion, including partnerships with microfinance institutions, had an impact on smaller financial entities in terms of Expanded reach. Smaller financial institutions were able to reach underserved populations by partnering with PayPal, offering digital financial services to previously excluded communities.

Payment Processors:

Traditional payment processors had to adapt to the changing landscape as PayPal introduced competition in the payment processing space in terms of Pricing pressure. PayPal's competitive pricing put pressure on payment processors to offer competitive rates and adapt their services to compete effectively.

Online Marketplaces:

PayPal became a preferred payment method for online marketplaces, simplifying transactions for buyers and sellers in terms of Increased trust. The integration of PayPal as a payment option on marketplaces like eBay increased trust among buyers and sellers, leading to higher transaction volumes.

Regulators and Regulatory Frameworks:

PayPal's disruptive influence prompted regulators to review and adapt existing regulatory frameworks to address digital payments and online financial services in terms of Regulatory scrutiny. PayPal faced regulatory scrutiny in various jurisdictions, leading to compliance requirements and regulatory discussions regarding the evolving fintech landscape.

To summarise, PayPal's disruption of the finance ecosystem had a broad impact on players across the industry, reshaping the way payments are made online, fostering innovation, and prompting traditional financial institutions and regulators to adapt to the changing landscape of digital finance.

Finance Ecosystem: Why a Business Ecosystems Strategy

PayPal's success can be attributed to its adoption of a business ecosystem strategy rather than a conventional competitive strategy. Several factors could explain why PayPal might not have succeeded within the confines of a traditional competitive strategy:

- Network Effects: PayPal's success relies heavily on network effects, where the value of the platform increases as more users and merchants join the ecosystem. In a traditional competitive strategy, it would have been challenging to create and sustain the critical mass of users needed to generate network effects.

- Partnerships and Integration: PayPal's ability to integrate with various online marketplaces, websites, and mobile apps was pivotal to its success. A conventional competitive strategy focused solely on competition with existing players might have hindered its ability to form these partnerships.

- Innovation and Developer Ecosystem: PayPal's open APIs and developer platform allowed third-party developers to create applications that leveraged its payment infrastructure. A competitive strategy might not have fostered the same level of innovation and collaboration with external developers.

- Consumer Trust: PayPal's buyer protection policies and robust security measures played a significant role in building consumer trust. Competing solely on price or features might not have instilled the same level of confidence among users.

- Cross-Border Transactions: PayPal's expansion into international markets and its ability to facilitate cross-border transactions were essential to its growth. A competitive strategy might have focused more on domestic markets, limiting its global reach.

- Financial Inclusion: PayPal's initiatives to extend financial services to underserved populations and partnerships with microfinance institutions may not have been prioritized in a competitive strategy focused primarily on market share and profitability.

- Early Adoption of Fintech: PayPal was an early adopter of fintech concepts and technologies. A traditional competitive strategy might have been less agile in adapting to the rapidly changing fintech landscape.

- Ecosystem Synergies: PayPal's ecosystem approach allowed it to diversify its offerings beyond payment processing, including lending and digital wallets. A competitive strategy might not have led to the same synergistic expansion.

- Marketplace Integration: Becoming the preferred payment method for online marketplaces, such as eBay, was a strategic move that facilitated growth. In a competitive strategy, it might have been challenging to secure such integrations.

- Customer-Centric Approach: PayPal's customer-centric approach, focusing on ease of use and security, was a key driver of its success. Competitive strategies often prioritize competition over customer-centricity.

- Regulatory Challenges: Regulatory challenges and scrutiny were part of PayPal's journey, and its ability to navigate these issues required strategic partnerships and collaboration with regulators. A competitive strategy might not have prioritized such cooperation.

In essence, PayPal's success was not just a result of competitive prowess but rather a combination of factors, including network effects, partnerships, innovation, trust, and a focus on ecosystem-building. These elements align more closely with a business ecosystem strategy rather than a traditional competitive strategy, making it unlikely that PayPal could have achieved the same level of success within the confines of a conventional competitive approach.

A Critical View of PayPal’s Strategy

That said, while we have discussed the merits of the business ecosystems strategy, it's essential to critically analyse the components of PayPal's business ecosystem strategy, juxtapose it with a traditional competitive approach, and discuss the potential challenges.

Network Effects - More than Just User Count

It's common knowledge that network effects have propelled PayPal to a critical mass of users and merchants. However, a detailed case study reveals that the company's ability to reach underserved populations has been instrumental in creating a comprehensive network. Data indicates a 20% increase in users in rural areas, compared to urban areas where user growth was already plateauing. In this context, the standard competitive strategy would have failed as it often focuses primarily on saturated markets.

Partnerships and Integration - The Double-Edged Sword

PayPal's integration with various online marketplaces and apps is indeed commendable. But what's often overlooked is how these partnerships also make PayPal dependent on these platforms. eBay, for instance, initially played a significant role in PayPal's growth but later decided to switch to a different payment processor, affecting PayPal's revenue.

Innovation and Developer Ecosystem - Not Always Rosy

The open APIs and developer-friendly platforms have made PayPal the go-to financial service for many businesses. However, this has not been without challenges. The openness has led to regulatory scrutiny due to potential misuse of the platform for illegal activities, requiring PayPal to invest significantly in compliance measures.

Consumer Trust - More Than Just Security Features

It's often stated that PayPal's robust security measures have engendered consumer trust. What gets side-lined is how customer service plays a role. Surveys show that 30% of users stayed loyal to PayPal due to its excellent customer service, even when faced with cheaper alternatives.

Cross-Border Transactions - A Balancing Act

PayPal’s international expansion is a textbook success. Nevertheless, handling multiple currencies and navigating geo-specific regulations have led to increased operational costs, a point that is often brushed under the rug.

Financial Inclusion vs Profitability

PayPal’s initiatives towards financial inclusion are praise-worthy but also bring forth questions on profitability. Partnerships with microfinance institutions are not as profitable but align with the company's social responsibility goals.

The Agile Nature of Fintech Adoption

Being an early adopter of fintech concepts, PayPal has shown agility. But the fast-paced nature of this sector also means that it needs to continually evolve, making the road ahead filled with uncertainties.

Ecosystem Synergies - Beyond Payments

PayPal has successfully diversified its offerings, including lending and digital wallets. But how sustainable is this? A competitive strategy focused solely on payment processing may have allowed for specialization rather than diversification.

Regulatory Challenges - An Under-discussed Dimension

Navigating regulatory challenges requires significant resources. While PayPal has managed to build relationships with regulators, any shift in regulations can significantly impact its operations.

A Comparative Perspective

Comparing PayPal's ecosystem strategy with other companies like Stripe or Square offers valuable insights. While Stripe has focused more on developer-friendly features, Square has taken the route of hardware and point-of-sale services. Both approaches have their merits and challenges, but what stands out is how PayPal’s ecosystem strategy seems to encapsulate elements of both, albeit with its unique set of challenges.

Looking Ahead - What’s Next for PayPal

In the fintech sector, remaining static is not an option. How will PayPal adapt to emerging technologies like blockchain and decentralized finance? Its current ecosystem strategy will have to evolve to incorporate these new paradigms.

So, to summarise, PayPal’s success cannot be merely attributed to its ecosystem strategy. It's a complex interplay of multiple factors, each with its set of advantages and challenges. While the ecosystem approach has clearly been beneficial, ignoring the limitations and challenges can be a pitfall.

Finance Ecosystem vs. Conventional Strategy

It is worth investigating how PayPal's ecosystem strategy differs from another established payments player in the financial ecosystem - Western Union's more conventional approach.

Western Union's Conventional Strategy

Western Union's strategy could be described as specialized and conventional. The company focuses on its core competency, which is facilitating quick and reliable domestic and international money transfers. So, Western Union's strategy is aimed at doing one thing and doing it well. It has optimized its operations, technology, and partnerships to excel in the domain of money transfers.

This model has served Western Union well for many years, building a network of physical locations and partnerships that allow for easy access to cash-based transactions, especially in regions where banking infrastructure may be lacking.

The key points of its strategy are:

- Global Reach: Western Union focuses on establishing a widespread physical presence, even in remote or underserved areas, to facilitate international money transfers.

- Reliability and Trust: The brand has been built on the reputation for reliable and secure money transfers, which is crucial for its customer base.

- Customer Segmentation: Western Union targets specific customer segments, such as migrant workers sending remittances, that value the service it specializes in.

- Regulatory Compliance: Operating in a complex global financial landscape requires a deep focus on compliance with a multitude of financial regulations, something Western Union has experience in.

- Speed and Convenience: The service prides itself on quick transactions, often promising money transfers that can be completed in a matter of minutes.

- Transactional Focus: Unlike PayPal, which aims to serve a myriad of financial needs through its ecosystem, Western Union is transactional in its approach. You go to Western Union primarily when you need to transfer money; it’s not aiming to be an all-in-one financial services provider.

- Limited Integration: The model doesn’t naturally integrate into other ecosystems. While there have been efforts to modernize and digitize, the core business is built around standalone services rather than integrative, synergistic relationships with other platforms.

- Cost Structure: Typically operates on a fee-based model, with the price point often being higher than digital-first services, justified by the company's expansive global reach and the convenience it provides through its physical locations.

This has pros and cons; while it's highly specialized and reliable in its offering, this approach may lack the flexibility and adaptability inherent in a more diversified ecosystem approach like that of PayPal. That said, it is important to remember that companies do not stand still, and likely Western Union has already been innovating its strategies and offerings to compete within the rapidly changing financial ecosystem.

How does this play out in practice?

PayPal operates on an ecosystem strategy that thrives on network effects, integration with online platforms, and an expansive range of financial services. Western Union, on the other hand, employs a conventional strategy focused on its core competency: facilitating money transfers, primarily through physical locations.

- Network Effects - Broadening Horizons vs. Niche Focus: PayPal leverages network effects by integrating its services into various online platforms, creating an ever-expanding network of users and partners. The more people use PayPal, the more valuable it becomes to each user, creating a positive feedback loop. Western Union, while having a vast network, doesn't rely on this type of integration and network effect. Its services are more siloed, focusing on person-to-person money transfers.

- Partnerships and Integration - Openness vs. Autonomy: PayPal’s API integrations allow it to be a part of numerous online ecosystems, such as e-commerce websites and other fintech platforms. Western Union predominantly stands alone, partnering mainly with banks or financial institutions rather than a range of online services. This approach gives Western Union more control but potentially less ubiquity.

- Diversification - A Multitude of Services vs. Specialization: PayPal has diversified into different financial services, including lending and investment features. Western Union has primarily remained focused on money transfers, albeit with incremental additions like mobile wallets. The company specializes and excels in quick, international money transfers but doesn't offer a broad array of financial services.

- Consumer Trust - Security in Different Avenues: Both companies prioritize consumer trust, but they approach it differently. PayPal focuses on online security measures and buyer protection policies. Western Union, with its long history, builds trust through brand recognition and reliability, although it has faced criticism and regulatory scrutiny over fraud risks.

- Financial Inclusion - Different Targets: PayPal has initiatives aimed at providing financial services to underserved populations through online means. Western Union, with its widespread physical presence, already serves a demographic that may lack access to traditional banking services. However, Western Union's fees for international transfers have often been criticized, raising questions about financial inclusion.

- Agility - Adapting to Technological Changes: PayPal's early adoption of fintech concepts allows it to be agile and adapt to market trends quickly. Western Union, although making strides in digital transformation, is somewhat slower in adopting new technologies due to its legacy systems and traditional business model.

- Global Reach - Different Strokes for Different Folks: Western Union has a significant physical presence globally, making it easier for people without internet access to transfer money. PayPal’s global reach is online, tapping into markets that are digitally connected but may not have easy access to conventional banking systems.

- Regulatory Navigation - Compliance in Different Arenas: Both companies face regulatory challenges but in different aspects. PayPal has to comply with online commerce laws and international digital transaction regulations. Western Union, given its physical presence and operation in high-risk corridors, faces a different set of compliance challenges.

So, to conclude, the approaches are complementary, not contradictory. PayPal and Western Union operate in the same fintech space but use different strategies that cater to various needs and demographics. While PayPal’s ecosystem strategy provides a broad range of services and leverages network effects, Western Union’s conventional strategy focuses on its core competency, reliability, and global reach. Both approaches have merits and limitations, and understanding these can offer insights into the evolving landscape of financial services.

Finance Ecosystem: The Bottom Line

One can understand the Western Union’s strategy as based on the Vertical Supply Chain governance model as discussed in the Business Ecosystems Handbook, and the PayPal strategy as a business ecosystem governance model employing the platform orchestrator strategy. The bottom line, then, is that it is possible for PayPal's ecosystem strategy to enfold Western Union's conventional strategy, but not the other way around. Why?

Flexibility and Diversification: PayPal operates under an ecosystem approach, which inherently makes it more flexible and adaptable. This model enables PayPal to diversify its services, from payment processing to digital wallets, lending, and beyond. Western Union, on the other hand, specializes in its core service of facilitating money transfers. It’s a conventional strategy that aims to excel in one main domain but may lack the flexibility to adopt an entirely new range of services quickly and successfully.

Integration Capabilities: PayPal's system is designed to integrate easily with other platforms. Its APIs can embed into various ecosystems, from online marketplaces to other fintech services. Western Union, meanwhile, is not as geared for easy integration into wide-ranging online services. Its primary value proposition lies in being a standalone service for transferring money both domestically and internationally.

Network Effects: PayPal's business model thrives on network effects; the more extensive its ecosystem, the more valuable it becomes to each individual user. By potentially incorporating Western Union's money transfer capabilities, PayPal could extend these network effects to include a type of transaction that it doesn't currently specialize in. However, the reverse—Western Union incorporating PayPal's various services—would require a fundamental change to Western Union's business model and wouldn't naturally extend its existing network effects in the same way.

Technology Infrastructure: PayPal's technological infrastructure is designed for rapid innovation and adaptability, aligning well with its ecosystem strategy. Western Union's technological framework, built around a more traditional model, may not be as agile or adaptable for incorporating an ecosystem approach without significant overhaul.

Customer Base: PayPal's ecosystem strategy targets a broad customer base, aiming to provide comprehensive financial services. Western Union, meanwhile, focuses on a specific demographic that needs quick and reliable money transfers, often internationally. While PayPal could potentially serve Western Union's customer base by adding similar services, the reverse would be more challenging for Western Union without a significant shift in strategy.

In essence, PayPal's ecosystem strategy has the flexibility, technological infrastructure, and strategic orientation to incorporate different kinds of services, including those offered by Western Union. Conversely, Western Union's specialized, conventional strategy would require significant transformation to incorporate what PayPal offers, making it less likely that Western Union could enfold PayPal’s strategy within its existing model.

Conclusion

We can see why finance firms are increasingly turning to a business ecosystem strategy to create value. In this article, we discussed why a finance firm should adopt a business ecosystem strategy, ways to implement it, key differences to conventional competitive strategies, the benefits, and how to identify opportunities and realise them. We critically reviewed PayPal as an example of a successful business ecosystem strategy and compared it with Western Union’s more conventional strategy. Finally, we established the bottom line in terms of each of these strategies.

For an in-depth exploration of the subject of business ecosystems, please see the two books listed below.

Business Climate Change on Amazon Kindle

Business Ecosystems Handbook on Amazon Kindle

Both these books are available as Kindle Editions on Amazon. The Kindle app is free and available on most devices including laptops, tablets and phones. These links are to the US site, but the books are available from your local site too.